Capital gains should be counted as wages–to a point

If you pay attention to the news, you have heard Warren Buffet claim that he pays a lower tax rate than his secretary. This pronouncement has prompted President Barack Hussein Obama to propose new taxes, affectionately nicknamed “Buffet taxes” or the “Buffet Rule.”

If you pay attention to the news, you have heard Warren Buffet claim that he pays a lower tax rate than his secretary. This pronouncement has prompted President Barack Hussein Obama to propose new taxes, affectionately nicknamed “Buffet taxes” or the “Buffet Rule.”

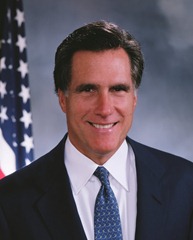

The “Buffet Rule” is going to get a lot of press attention in the coming weeks and it will get more attention if Mitt Romney successfully wins the nomination of the Republican Party.

At this writing, Mitt Romney is running for the Republican nomination and at some time he is probably going to have to divulge his finances more fully than he has already. Mr. Romney doesn’t appear to have a wage-earning job, therefore, his daily spending on clothes, food, mortgage, and hair-styling products comes from interest, capital gains, or dividend income from his earned fortune. It appears that Mr. Romney paid less than 15% on his income where a wage earner would pay a much higher rate.

At this writing, Mitt Romney is running for the Republican nomination and at some time he is probably going to have to divulge his finances more fully than he has already. Mr. Romney doesn’t appear to have a wage-earning job, therefore, his daily spending on clothes, food, mortgage, and hair-styling products comes from interest, capital gains, or dividend income from his earned fortune. It appears that Mr. Romney paid less than 15% on his income where a wage earner would pay a much higher rate.

A lot of people say that the tax code is broken and I agree. Some propose a flat tax rate for all income, but that is probably a political hot potato. A flat-tax is also a little repressive as low wage earners probably shouldn’t have the same tax rate as the more affluent.

In America, everyone can have an opinion. So here is my suggestion:

- All Americans should pay a minimum of 1% of their income in Federal taxes. The approximately 46% of Americans who pay no taxes needs to stop. If everyone pays at least a little bit, then they all are part of the general sharing of the load. Everyone will be a bit more invested in making sure that the spending is appropriate.

- All income, regardless of source, needs to be considered wage income for the first $500,000. The top line of your income for federal taxes needs to include all wages that come from your W2 or 1099. If that number is less than $500K, then include dividend and capital gains income up to $500K. Why did I choose $500K? It seems like a fair number. I could make an argument that it should be up to $1M, but I cannot make a logical argument that it is less than $300K. Here is my logic:

- Everyone has daily expenses that need to be paid. For most Americans, these expenses are covered with our income from our job. The expenses are things such as food, clothes, house and car payments, cable TV, the occasional movie and dinner out, and (since Mitt’s expenses in this area are likely quite high) hair care products.

- Money that covers these regular expenses comes from wages for all but the most affluent Americans.

- It is not appropriate that those that are very wealthy and do not make a wage should have the source of funds for expenses categorized as anything but wages. Even if they don’t make a wage and received the money from dividends or interest, a portion of that income is used for exactly the same thing as the minimum wage earner. Therefore, we need to classify it as a wage since that is what it is replacing.

- FICA is currently capped at first $110,100 of income. This needs to change. The upper cap needs to be on all wages as I have described in the previous bullet. This is fair, as well. All wages should be subjected to FICA tax. This would likely fix the problem of Social Security being underfunded for quite some time. Yes, I think that Social Security should be eliminated, but that isn’t going to happen either.

The great thing about a blog is that I can rant. There is little chance that any of the above will ever be enacted. It was fun to argue the point though and I hope that it was fun for you to read.

The images in this post are assumed to be in the public domain. I have linked to the sites where I found them. I do not own the copyright for these images.