Capital gains should be counted as wages–to a point

If you pay attention to the news, you have heard Warren Buffet claim that he pays a lower tax rate than his secretary. This pronouncement has prompted President Barack Hussein Obama to propose new taxes, affectionately nicknamed “Buffet taxes” or the “Buffet Rule.”

If you pay attention to the news, you have heard Warren Buffet claim that he pays a lower tax rate than his secretary. This pronouncement has prompted President Barack Hussein Obama to propose new taxes, affectionately nicknamed “Buffet taxes” or the “Buffet Rule.”

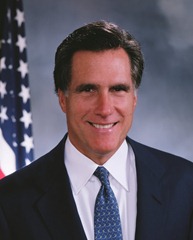

The “Buffet Rule” is going to get a lot of press attention in the coming weeks and it will get more attention if Mitt Romney successfully wins the nomination of the Republican Party.

At this writing, Mitt Romney is running for the Republican nomination and at some time he is probably going to have to divulge his finances more fully than he has already. Mr. Romney doesn’t appear to have a wage-earning job, therefore, his daily spending on clothes, food, mortgage, and hair-styling products comes from interest, capital gains, or dividend income from his earned fortune. It appears that Mr. Romney paid less than 15% on his income where a wage earner would pay a much higher rate.

At this writing, Mitt Romney is running for the Republican nomination and at some time he is probably going to have to divulge his finances more fully than he has already. Mr. Romney doesn’t appear to have a wage-earning job, therefore, his daily spending on clothes, food, mortgage, and hair-styling products comes from interest, capital gains, or dividend income from his earned fortune. It appears that Mr. Romney paid less than 15% on his income where a wage earner would pay a much higher rate.

A lot of people say that the tax code is broken and I agree. Some propose a flat tax rate for all income, but that is probably a political hot potato. A flat-tax is also a little repressive as low wage earners probably shouldn’t have the same tax rate as the more affluent.

In America, everyone can have an opinion. So here is my suggestion:

- All Americans should pay a minimum of 1% of their income in Federal taxes. The approximately 46% of Americans who pay no taxes needs to stop. If everyone pays at least a little bit, then they all are part of the general sharing of the load. Everyone will be a bit more invested in making sure that the spending is appropriate.

- All income, regardless of source, needs to be considered wage income for the first $500,000. The top line of your income for federal taxes needs to include all wages that come from your W2 or 1099. If that number is less than $500K, then include dividend and capital gains income up to $500K. Why did I choose $500K? It seems like a fair number. I could make an argument that it should be up to $1M, but I cannot make a logical argument that it is less than $300K. Here is my logic:

- Everyone has daily expenses that need to be paid. For most Americans, these expenses are covered with our income from our job. The expenses are things such as food, clothes, house and car payments, cable TV, the occasional movie and dinner out, and (since Mitt’s expenses in this area are likely quite high) hair care products.

- Money that covers these regular expenses comes from wages for all but the most affluent Americans.

- It is not appropriate that those that are very wealthy and do not make a wage should have the source of funds for expenses categorized as anything but wages. Even if they don’t make a wage and received the money from dividends or interest, a portion of that income is used for exactly the same thing as the minimum wage earner. Therefore, we need to classify it as a wage since that is what it is replacing.

- FICA is currently capped at first $110,100 of income. This needs to change. The upper cap needs to be on all wages as I have described in the previous bullet. This is fair, as well. All wages should be subjected to FICA tax. This would likely fix the problem of Social Security being underfunded for quite some time. Yes, I think that Social Security should be eliminated, but that isn’t going to happen either.

The great thing about a blog is that I can rant. There is little chance that any of the above will ever be enacted. It was fun to argue the point though and I hope that it was fun for you to read.

The images in this post are assumed to be in the public domain. I have linked to the sites where I found them. I do not own the copyright for these images.

Should America vote online?

Today is election day in much of the US. It isn’t a Presidential Election so many people won’t vote. Most municipalities will have a few referendums, some school board officials, and maybe a judge or city councilman on the ballot. Since it is not a big election with a lot of TV time, the turnout was relatively low and so conversations start to theorize about voting online.

The argument goes that I can buy many things if not everything that I need online, why can’t I vote? This is much the argument that CNN made today. Unfortunately one cannot make this comparison and even if that comparison was valid, we still shouldn’t do it.

- Ecommerce is not as safe as you think it is.

- It is inherently unfair to the poor.

Ecommerce is not as safe as you think it is

In the case of ecommerce there is a level of risk that is taken by the seller, bank, and user. That risk is managed but is far from perfect. It also requires a fairly high level of personal data to be shared and yet is still not foolproof. The estimated fraud rate is at 0.9% which is far higher than is allowed in voter counting error! In addition, stores reject over 2% of all transactions.

In most municipalities, a recount can be justified if the race is within one percent. If we would implement a system based on our existing ecommerce technologies that would force a recount if the vote was within 4 or 5% (1% for too close, 0.9% for fraud, 2.5% for obvious fraud). Would you accept it if the voting system said it doesn’t believe that this you are a valid voter so it is rejecting it and you will now need to go to your voting booth even though it is 5:45PM. You would almost certainly sign the petition of your candidate saying that you were denied the right to vote even though you were legitimate and therefore the votes should be recounted or invalidated.

Couple this with the safety and honesty of voting today. In the US, a voter can be harassed and beaten up before and after they enter the polls but once they walk into the building they are very safe. Unless they specifically ask for assistance, they have no one looking over their shoulder. Even when they ask for assistance the process is usually two people of opposite parties help the individual to insure no undue influence is happening. Contrast that to the activist preacher that has coffee and cookies at his house and invites all of his members to come over and use his computer to vote and is right there to help you with all of the intricacies including making sure you push the right radio buttons.

With ecommerce fraud, there is the transfer of goods, services, or money to the criminal. This means that there are clues as to that criminal’s identity and potentially over time the police can catch that criminal. With internet voting, it happens once or maybe twice per year and the transfer of wealth is extremely hard to connect.

The ecommerce systems also requires a huge amount of personal data that consumers are willing to share with their bank and their store but NOT their government. Can you imagine the outcries if you were required to have a credit card or a bank account and a phone number to vote! In the process of checking your credit card, the processing company can check to see if you are paying your bills – no way the government is going to get that right.

Until we allow a national identification system with biometrics, there really can be no online voting and you shouldn’t trust it if it was there.

It is inherently unfair to the poor

The bigger issue is that it is heavily biased to the rich and likely even the white voters. We already have complaints that internet access is difficult for poor and colored people (Jesse Jackson likes to talk about this in his speeches).

Without being too racist or too broadly generalized, rich white people that can afford to have lots of computers in their homes (1 plus for every adult for sure) could easily vote without having to brave the storms, ice, and cold. It would almost certainly give them nearly 100% participation and they normally vote Republican or at least are more likely to vote Republican.

But what about the working stiff that is barely making minimum wage and therefore cannot afford to own a couple computers with high speed internet. Let him brave the snow and ice. He is poor and generally speaking is a Democrat so make him go to the voting booth in the back of some school or church, wait in line, and fill out the manual forms that are reserved for the poor people. The really travesty is that since there will be less rich people at the polls then we don’t need so many of those expensive polling machines and booths and we can have fewer polling locations. Those poor people can take the bus farther to vote.

So even when it is technically possible to vote online, until we can make the access to that voting infrastructure equal we shouldn’t do it. Thurgood Marshall taught us that “separate but equal” is never possible. We cannot make it easier to vote for the wealthy than it is for the poor. It probably already is slanted this way with access to transportation and more flexible work hours but at least all people, rich or poor, need to trudge to the same voting location to make their voice heard.

Uganda’s treatment of gays is reprehensible

I once again find that I am commenting on the laws of another nation where I am not a citizen. I recently read a story that Uganda has publicly “outed” 100 gays. Not only did the paper publicize the names of the homosexuals but placed a banner on the newspaper saying “Hang Them”. At the time of the article in The Washington Post, at least 4 men on the list have been attacked.

This is reprehensible conduct. What is worse is our support of a society that allows this. The US will give approximately $400M to Uganda in aid in 2010. We need to put strings on this money. It doesn’t come free. The recipients of this aid must not have laws that will cause more hardship to some of its citizens. We can enhance the benefit of that aid to more than just children that need medicine by requiring these countries to adopt standards that approximate the realities of human rights in the 21st century.

I understand that withholding aid to countries with low human rights ratings will hurt the most disadvantaged in that country. But, by providing aid to those that are disadvantaged we are also propping up and supporting the government of the country. We should not be friends with countries that have a low level of human rights standards.

What is even more disgusting is that it appears that some of this hatred was seeded by people from the US that say that they are Christians. This is not Christian behavior! I would write about these groups that instigated this behavior if I could find their names but the article only mentions them in one paragraph and then doesn’t delve into them in more detail.

A few paragraphs from the Washington Post:

The front-page newspaper story featured a list of Uganda’s 100 “top” homosexuals, with a bright yellow banner across it that read: “Hang Them.” Alongside their photos were the men’s names and addresses.

In the days since it was published, at least four gay Ugandans on the list have been attacked and many others are in hiding, according to rights activist Julian Onziema. One person named in the story had stones thrown at his house by neighbors.

A lawmaker in this conservative African country introduced a bill a year ago that would have imposed the death penalty for some homosexual acts and life in prison for others. An international uproar ensued, and the bill was quietly shelved.

But gays in Uganda say they have faced a year of harassment and attacks since the bill’s introduction.

The legislation was drawn up following a visit by leaders of U.S. conservative Christian ministries that promote therapy they say allows gays to become heterosexual.

Tax plan just doesn’t seem to be fair

President Barack Hussein Obama has been talking about his new plan to invigorate the economy and move us out of a double-dip or very long recession. I have to admit that I am confused by his logic.

First, a bit about myself. I hate taxes. I know that I need to pay them. I know that I make a good living (not from this blog mind you) and I need to pay into the system more than some others that don’t work as hard as I work. I get all of that.

In general though, I don’t want to pay taxes and I definitely don’t want to pay MORE taxes. I would much prefer that the federal, state, and local governments do a better job of using my money wisely. I would also appreciate that my money is not transferred to someone that won’t work (strong distinction from “can’t work” and “can’t find work”). In fact, if an adult WON’T work then I am perfectly comfortable with that adult starving to death and dying. Probably my only regret in that scenario is that my tax dollars will likely have to go to bury his sorry body. I realize that this isn’t a very Christian attitude but, frankly, God gave that adult man or woman 2 legs, 2 arms and a brain to use to work – not to live off of the generosity of others.

Now, back to the President’s proposals. I just don’t get it. Something doesn’t make sense. According to CBS News:

President Barack Obama will call on Congress to pass new tax breaks that would allow businesses to write off 100 percent of their new capital investments through 2011, the latest in a series of proposals the White House is rolling out in hopes of jump-starting economic growth ahead of the November elections.

An administration official said the tax breaks would save businesses $200 billion over two years, allowing companies to have more cash on hand. The president will outline the proposal during a speech on the economy in Cleveland, Ohio, on Wednesday.

I understand that part on a simplistic level. It makes perfect sense to me that if businesses don’t have to pay taxes on capital investments, they will be able to justify more money (the original money plus the tax money they didn’t have to spend) on capital investments. They might even spend more money on that as the internal return on that investment would be a little bit better without the tax overhead. This would potentially mean more purchases of goods by businesses which, in theory, would spark more jobs to be created.

However, according to the Washinton Post:

Corporate America is hoarding a massive pile of cash. It just doesn’t want to spend it hiring anyone.

Nonfinancial companies are sitting on $1.8 trillion in cash, roughly one-quarter more than at the beginning of the recession. And as several major firms report impressive earnings this week, the money continues to flow into firms’ coffers.

This means that the businesses are doing well, even if people are not doing well. So the President’s message is that we need to give these rich businesses an incentive to have them spend the money and that incentive will be taxes. I guess that makes sense. How about doing the reverse though? Why not tax them on the cash that they leave laying around and don’t invest? That way the US coffers don’t go down but actually might go up if they don’t spend it AND we get the benefit of increasing capital expenditures. In fact, we might get MORE business spending with my plan. Why not heavily tax any cash that is in excess of last year’s cash reserves for the company.

It gets a bit more confusing. When it comes to people, the President feels the exact opposite as he does on businesses. He is fully okay with taxing a person more if they make more money. He wants to increase taxes on those that make a certain amount ($250K seems to be the magic number right now). This is exactly the opposite of what he is doing for businesses. For people he isn’t incenting them to spend more money to jumpstart the economy, he is simply taxing them for making more money.

If a person last year made $220K and then had a great year and made $275K, the President wants to sock it to that enterprising citizen. He wants to charge him more for the right to be a US citizen and live in this great land. That 25% increase is going to drive that individual to pay a much higher rate of income tax. But not the company that is in the same city as the individual. That company has increased its cash by 25% (according to the article cited above) and it is receiving a tax break, not a tax bill.

How about a similar offer to people, Mr. President? How about you say that you don’t have to pay taxes on anything that you buy that generates manufacturing jobs in the US. Buy a car – get a tax write-off for your down payment. Buy a house – get a tax write-off for your down payment. Replace the windows in your house – no taxes on that money. Buy a pizza – that isn’t taxable either. Even your latte at Starbuck’s should have no taxes if you treated people like you treat corporations. Buy a TV or computer manufactured in China though and you pay income taxes. Sorry Best Buy and Apple – you get screwed in my plan but not really since it just remains status quo for you. The people that benefit are the people that live within the borders of the land of the free and the brave.

Like I said above, I don’t like taxes. I know that there has to be some taxes because I want to have those brave soldiers that rescue ships that are attacked by pirates. But how about a little common sense and fair play when it comes to the tax burden.

Banking problem: 5 rules for a possible solution

Even though the economy is slowly starting to recover from the excesses of spending of the George W. Bush administration (and the equally complicitous Congress), we are still far from out of the woods. The economy is in pain, in addition to the overspending, due to poor financial market regulation which destroyed several top-notch financial firms such as Lehman Brothers (who also appeared to break some standard accounting laws and best practices). The government responded to help these big institutions because they were “too big to fail.”

Let’s face it – there should be no such thing as “too big to fail.” Most of us work for companies that are not in that category. If our employers screw up and the company goes down the tubes then we will individually hurt and perhaps the micro-economy around that company will hurt a bit but for the most part the US GDP won’t even see the speed bump. This is the way that it should be – screw up and fail then just pick yourself up and get on with life.

“Too big to fail” simply stinks of a type of monopoly. I know that monopoly prevention is usually about consumer rights and price gouging, but is this that far from where we are now? Isn’t consumer price gouging exactly what we just went through with the TARP program? I know that my taxes feel like I am getting gouged! This is especially true when I know that I am paying way too much in taxes and that still doesn’t cover what the US government spends! If it is a choice between taxing me more and the US Government (and the state governments) spending more, than I know the choice that I want to make – cut the damn spending!

So what is my suggestion?

The FDIC was nice enough to give us a list of banks here. The first thing that I see is there are some BIG banks! How can these not be monopolistic when they are that much larger than banks that are ranked just 10 places below them. We need some sanity here.

- No bank in the top 100 largest banks can be larger than double the size of the next smallest bank.

- No bank in the top 100 largest banks can be more than five times larger than a bank that is ranked 10 spots below it.

- No bank in the top 100 largest banks can be more than ten times larger than a bank that is ranked 20 spots below it.

- No bank in the top 100 largest banks can be more than twenty times larger than a bank that is ranked 40 spots below it.

- The top 100 banks combined size cannot exceed double the combined size of the banks ranked 101-500.

- No FDIC insured bank can have more than 10% of its ownership by a non-US entity.

Yes, I know that the title of this article only says 5 rules but the list has 6 rules. The last rule is simply to reduce our banking exposure to undue influence by foreign nationals. We need to realize that our banking and financial systems is just as much of a strategic US asset as our defense contractors. We want the decisions of our strategic institutions to be governed by good business intentions and not the political aspirations of a foreign body.

Because of all of this re-arrangement, we would have to do this with plenty of warning. I would suggest that the law wouldn’t take effect for 5 years after signing to give the banks time to adjust. Also, in the first 5 years after the law is in effect (years 6-10 after signing), the penalty should simply be a 1% fine for the amount of out of compliance the bank was in e.g. if a bank was too large by $1B than the fine would by $10M. After the first decade, a bank would be taken over by a government agency to accelerate their divestitures, existing management and board of directors would be fired (and forbidden to run a bank for 10 years), and then new management would be installed by the shareholders.

There would also need to be a grace period of perhaps 3 years if banks ranked lower than the bank in violation decreased their size by more than 10% in a year and that caused the non-compliance. We cannot punish one institution due to the acts of another. However, we can require them to adapt to the current situation within a reasonable time, I suggest 3 years.

What would this do for the financial institutions?

The first thing that would likely happen is that the banks below 500 would likely start to get bought up pretty rapidly by the banks that are 101-500.Also, the top 100 banks would start to divest portions of their business to other banks (or create new entities) so that they could balance out. It definitely would mean that the top 10 banks would get smaller relative to the next 20 banks. That is the point, they would no longer be too big to fail. While we wouldn’t want them to fail, we also wouldn’t be on the hook as taxpayers to fix their screw-ups.

With the built-in delays and grace periods, it would probably take 20 years to get to a better balance. That is okay. In the words of some great philosopher: haste makes waste. It took us several decades to get the current mess that we are in and if we try to adjust too quickly, we will screw it up.

I know that there will be a lot of nay-sayers that think this won’t work or some other way will work better. I am sure there are good ideas out there but any idea that still concentrates wealth in the hands of a dozen corporations is simply not a solution to the core problem. Those suggestions are only to take care of a problem that presented itself already – in other words they are a band-aid to an existing cut. My suggestion is that we know that injuries and mistakes will happen in the future (banks will always fail) but let’s not get in trouble as a nation because of the problem.